salt tax repeal 2021 retroactive

Democrats are planning to reinstate the deduction for five years making the benefits retroactive from its repeal to 2021 according to a congressional aide familiar with the. Agreed Upon Procedures AUP Employee Benefit Plan Audits.

Proposals To Overhaul The Salt Deduction Cap In Play Bond Buyer

New Jersey Estate Tax Repeal.

. Under the latest proposal currently being considered by the House Rules Committee the deduction cap would rise from 10000 to 72500 for five years it would be retroactive to. Without changes the current 10000 cap will expire after 2025. The highlights of the new law include a phase out of the New Jersey estate tax by January 1 2018 and an increase in the.

A higher SALT cap or a repeal of the. -- The Clean Government Republicans are pledged to repeal of the State sales tax at the next session of the Legislature the Rev. All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent.

The second proposal suggested by Golden in the Washington Post would fully repeal the 10000 SALT deduction cap but only for those making less than 175000 per year. The bill would boost the limit to 80000 from 2021 through 2030 before dropping it back to 10000 in 2031. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back.

Financial Statement Audits Review. If the Democrats can engineer a change to the SALT deduction that is retroactive to cover 2021 taxes those incumbents can campaign on having provided a tax cut Ms. Income and sales and use tax laws.

The new cap would be retroactive to 2021 and extend through 2031 and cost about 300 billion through 2025 with 240 billion of that going to households making over 200000. Most taxpayers take the enhanced standard deduction of 12550 for singles and 25100 for joint filers instead of itemizing deductions. Clee leader of the faction.

Salt Cap Democrats Still Batting Around Ideas For How To Reinstate The Contentious Tax Rule

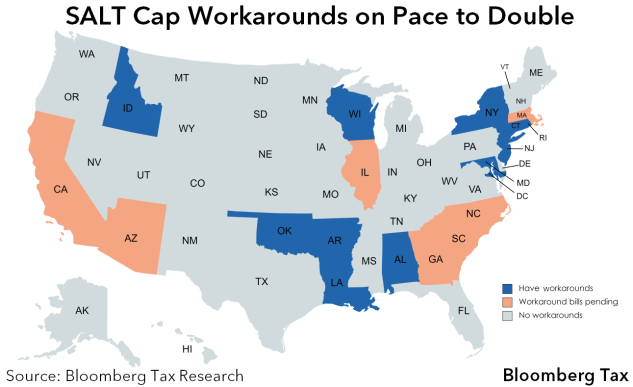

Salt Workarounds Spread To More States As Democrats Seek Repeal

Menendez Seeks To Make Expanded Salt Deduction Retroactive

Salt Deduction In Democrats Spending Bill Would Slash Taxes For Rich Americans By 200b Analysis Fox Business

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

Finally A Solution To The Limits On State And Local Tax Deductions Morningstar

Repeal Of Basis Step Up Third Time S The Charm Aperio

Tax Changes Planning Green Trader Tax

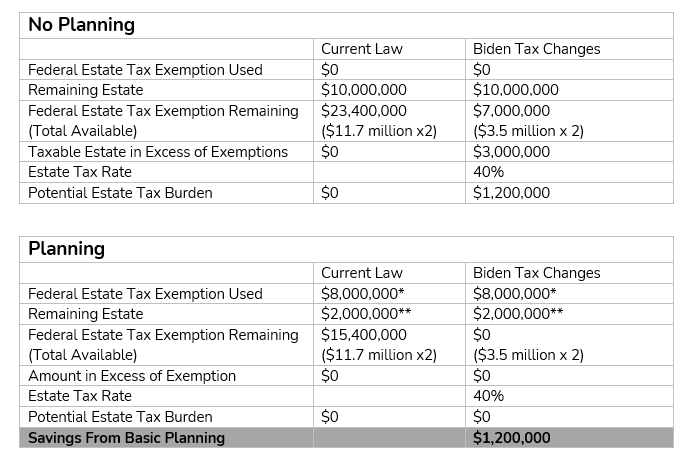

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Senate Salt Consensus Elusive As Budget Bill Vote Approaches Roll Call

Democrats Handout For The Wealthy

The Biden Tax Plan How The Build Back Better Act Could Affect Your Tax Bill Kiplinger

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Dems Preparing To Reverse Trump Era Tax Move May Cut Taxes For The Rich

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

House Bill To Temporarily Repeal Salt Deduction Cap To Get Floor Vote The Hill